THE LAST SANDWICH

SANDWICH NEWS

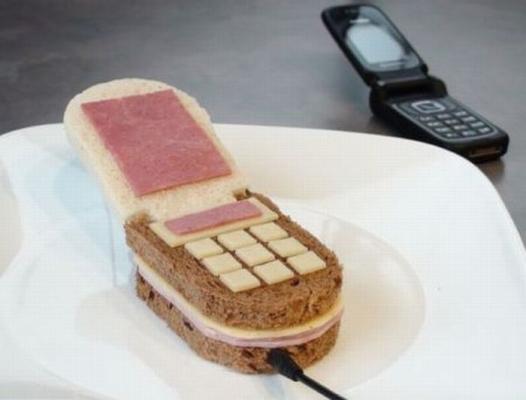

In the baking world, you always see chefs create Japanese cartoon characters out of meringue, cake, and pastries. Why don't we see that in the Sandwich making community too? Can you imagine how amazing it would be to eat a double ham with cheese that looks like Iron Man?

Well, they do, it's just as popular in America as it is in other parts of the world. So, today we are going to share our favorite looking sandwiches from overseas.

However, for those who are interested in stylish sandwiches instead of those featuring Japanese Cartoons, here is some more traditional sandwich art.

Pressed Italian Picnic Sandwiches

King George Sandwich

Le Normandie Panini Lukulus Sandwich

Is there really Double Irish with a Dutch Sandwich? I mean... does this actually exist? Do restaurants serve this? That question has weighed on my mind a long time.

In the accounting world, the Double Irish with a Dutch Sandwich is a term for tax avoidance. Some would even call it "Legal Cuisine". Basically, the scheme involves sending profits first through one Irish company, then to a Dutch company and finally to a second Irish company headquartered in a tax haven. (For those interested, we've included a more detailed explantion at the end of the article.) So... now that we've cleared that up, what about the actual sandwich itself? Is it real?

The answer to that question is... we don't know. However, we've produced our own recipe' below.

The Double Irish with a Dutch Sandwich Recipe'

INGREDIENTS

4 slices of bread

Butter

4 slices of ham

6 slices of cheese

8 slices of avacodo

Note: For this one, we are trying our best and it's a work in progress. However, we have included a couple other Dutch Sandwiches, which may be the next closest thing.

The Uitsmijter8 (Dutch Breakfast or Lunch Sandwich)

INGREDIENTS

2 slices of bread

Butter

2 slices of ham

4 slices of cheese

2 eggs

Instructions

Put two slices of bread on a plate, and butter them lightly. Put the slices of ham on the bread, then the cheese. Add butter to a skillet and fry the eggs. If you want, you can also fry the ham. When the eggs are done to your liking, slide them on top of the cheese, add some salt and pepper and you're ready to go!

Pennsylvania Dutch Sandwich7

INGREDIENTS

4 sl ham; Boiled

1/2 c Sauerkraut ; well drained

3 tb butter ; Soft, or margarine

4 sl Swiss cheese

1/2 ts Caraway seeds

12 sl Rye breadz

1/4 c Mayonnaise

Instructions

Cut ham and cheese into julienne strips. Blend caraway seeds and mayonnaise. Add ham and cheese. Stir to coat all pieces. Add sauerkraut. Spread bread with butter or margarine. Spread half of bread slices with ham-cheese mixture. Top with remaining bread slices. Wrap each sandwich with plastic wrap or foil and refrigerate. Yield: 6 sandwiches. CEILE FAULKNER (MRS. JIM) From , by the Little Rock (AR) Junior League. Downloaded from G Internet, G Internet.

The Breakfast Dutch Sandwich

Recipe

Toast

Peanut Butter (or Butter)

Sprinkles

Instructions

Toast a slice of bread, spread Peanut Butter over the top, and then put Sprinkles all over it.

Broodje kroket (Broodje)9

(Croquette in a Bun)

INGREDIENTS

A popular Dutch sandwich consisting of a deep-fried kroket stuffed inside a soft bread roll or a bun. The sandwich is usually drizzled over with spicy mustard and consumed as a flavorful, comforting midnight snack.

Okay, as promised, below is the explanation of the Accounting Sandwich...

How exactly does the Accounting Definition of a "Double Irish with a Dutch Sandwich" work in the real world?

Here is a very good explanation from another site, who we have obviously credited for writing.4

So the double Irish with a Dutch sandwich is a method of tax avoidance, which unlike tax evasion, is not outside of the law. In simple terms, it describes the method that multi-national corporations use to transfer profits from one country – with a higher tax rate – to another, with a lower tax rate. For example, if the corporate tax rate in Ireland is lower than it is in Australia, a company will shift its Australian profits to Ireland in order to avoid paying a higher rate of tax.

It works like this. Company A, the global leader in personal electronic devices, sells products in every country you could name. Australian consumers will buy the Chinese made gadgets from a subsidiary company based in Ireland. The Irish company that receives the sales revenue from Australians, pays royalties to a Dutch subsidiary company that owns Company A’s intellectual property rights (trademarks, patents, copyrights). In an astonishing coincidence, the value of the royalties paid by Company A’s subsidiary in Ireland to its subsidiary in the Netherlands happens to be roughly the same as the taxable income that was made on Company A’s Australian sales.

So Company A has moved the profit on its Australian sales from Australia to Ireland to the Netherlands. The next step is to take advantage of agreements that make capital transfers within European Union countries tax free. The Dutch subsidiary then makes a capital, transfer to a second Irish subsidiary of Company A. Under Irish tax law, a company is ‘managed’ by an overseas firm is only required to pay tax in that overseas jurisdiction. The second Irish company is ‘managed’ by yet another subsidiary of Company A in the Cayman Islands, or some other tax haven. In a repeat of the astonishing coincidence above, the value of the management services provided by Company A’s subsidiary in the tax haven is again equivalent to the taxable income from the Australian sales paid as royalties from Ireland to the Netherlands.

And so we get the double Irish with Dutch sandwich – a round robin of payments between two Irish companies with a Dutch company in the middle, far away from Australia where the profits were made and far more costly for Australians than a late night stop at the greasy burger joint. If it sounds farcical, that’s because it is. Companies employing this – and other like tax avoidance strategies – have no real connection with Ireland, the Netherlands, and whatever offshore tax haven is employed, other than to avoid company tax. And not surprisingly, it’s a huge problem, from both an economic and moral perspective.4

Definitions:

Double Irish with a Dutch Sandwich

The name of the scheme comes from setting up two Irish subsidiaries and one Dutch company in the middle of the tax structure.

The double Irish with a Dutch sandwich is a tax avoidance technique employed by certain large corporations, involving the use of a combination of Irish and Dutch subsidiary companies to shift profits to low or no-tax jurisdictions. The technique has made it possible for certain corporations to reduce their overall corporate tax rates dramatically.5

Dutch Sandwich

Dutch Sandwich is a base erosion and profit shifting (BEPS) corporate tax tool, used mostly by U.S. multinationals to avoid incurring EU withholding taxes on untaxed profits as they were being moved to non-EU tax havens (such as the Bermuda black hole). These untaxed profits could have originated from within the EU, or from outside the EU, but in most cases were routed to major EU corporate-focused tax havens, such as Ireland and Luxembourg, by the use of other BEPS tools. The Dutch Sandwich was often used with Irish BEPS tools such as the Double Irish, the Single Malt and the Capital Allowances for Intangible Assets ("CAIA") tools. In 2010, Ireland changed its tax-code to enable Irish BEPS tools to avoid such withholding taxes without needing a Dutch Sandwich.1

Double Irish

The Double Irish was a base erosion and profit shifting (BEPS) corporate tax tool used mostly by US multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. It was the largest tax avoidance tool in history and by 2010 was shielding US$100 billion annually in US multinational foreign profits from taxation, and was the main tool by which US multinationals built up untaxed offshore reserves of US$1 trillion from 2004 to 2018. Traditionally, it was also used with the Dutch Sandwich BEPS tool, however, changes to Irish tax law in 2010 dispensed with this requirement.2

BEPS (Base Erosion and Profit Sharing)

Base erosion and profit shifting (BEPS) refers to corporate tax planning strategies used by multinationals to "shift" profits from higher-tax jurisdictions to lower-tax jurisdictions, thus "eroding" the "tax-base" of the higher-tax jurisdictions. The Organisation for Economic Co-operation and Development (OECD) define BEPS strategies as "exploiting gaps and mismatches in tax rules".3

Corporate tax havens offer BEPS tools to "shift" profits to the haven, and additional BEPS tools to avoid paying taxes within the haven (e.g. Ireland's "CAIA tool"). It is alleged that BEPS tools are associated mostly with American technology and life science multinationals. A few studies showed that use of the BEPS tools by American multinationals maximised long–term American Treasury revenue and shareholder return, at the expense of other countries.3

References

1. Wikipedia (https://en.wikipedia.org/wiki/Dutch_Sandwich)

2. Wikipedia (https://en.wikipedia.org/wiki/Double_Irish_arrangement)

3. Wikipedia (https://en.wikipedia.org/wiki/Base_erosion_and_profit_shifting)

4. https://tharunka.arc.unsw.edu.au/double-irish-dutch-sandwich/

5. Investopedia (https://www.investopedia.com/terms/d/double-irish-with-a-dutch-sandwich.asp)

6. https://finshots.in/archive/the-double-irish-dutch-sandwich/

7. https://www.bigoven.com/recipe/pennsylvania-dutch-sandwich/3807

8. https://www.thedutchtable.com/2011/04/uitsmijter-ham-cheese-and-egg-sandwich.html

9. https://www.tasteatlas.com/broodje-kroket

Remember when the Bacon Sandwich destroyed Ed Miliband's Political Career in 2014 and 2015?

The bacon sandwich has a sort of cultural icon status in Britain as the food of the busy working classes. So, when Miliband had problems consuming it, a photographer snapped a photo, and within days it was spread across tabloids in the UK.

Well, the Bacon Sandwich scandal didn't last long. Soon afterwards, Ed Miliband was able to bounce back and became more popular than ever.

You can Google him to see some of the Memes, or you could just see the Top 3 Miliband Memes below..

Famous Memes:

When Harry Met Sally Met Hilibrand1

Hilibrand as George on Seinfeld2

Hilibrand at the Last Supper3

References

1. Link One

2. Link Two

3. Link Three